Chinese brands are taking over the European market

The UK is responsible for 30% of all Chinese car sales in Europe. Chinese brands such as BYD, Omoda and Jaecoo have seen a huge increase in UK sales recently, with BYD capturing 2.54% of market share in 2025. But why is this happening, and what does it mean for incumbent, established manufacturers in both the UK and global markets? Not to mention how it could impact consumers?

BYD is the world’s third-largest carmaker, behind only Tesla and Toyota. It saw UK sales increase by 485% in 2025, accounting for almost 25% of global EV sales during the year; not to mention it is now the top-selling EV brand in China, taking the crown held for several years by Tesla.

BYD Seal - Whole Life Cost calculator in Gensen Software

BYD achieved a 1% share roughly 10 times faster than other, more established, Asian manufacturers such as KIA or Toyota, and it achieved that feat faster than any other manufacturer in history, only to be surpassed by another Chinese manufacturer within a matter of months, as a swathe of Chinese manufacturers also began to make waves in the UK. Considerably larger workforces and the production of up to 75% of car parts in-house are prime reasons these new manufacturers are expanding so quickly; BYD employs nearly a million people globally.

Jaecoo and Omoda, owned by Chery, which now also operates in the UK under its own brand, exploded in popularity in the UK in 2025, with Jaecoo capturing a remarkable 1.4% market share, having only entered the UK market in late 2024.

The Chinese newcomers, which also include Changan, Leapmotor and Xpeng, have joined more established European brands now owned by Chinese companies, MG and Volvo, in becoming major players in the UK market. MG, now owned by SAIC Motor, a Chinese state-owned manufacturer, which has won awards for its EV models in the last few years, most notably with the MG4, has operated in the UK for around 20 years and commanded an impressive 4.21% market share in 2025.

The overarching question is why Chinese brands are selling more in the UK? There are a few reasons which can be attributed to the rapid expansion into the UK.

Most importantly, the UK is not imposing tariffs on Chinese imports, whereas the USA and the European Union do. Due to the tariffs, which reach a staggering 100% in the USA, Chinese manufacturers are pushing hard to establish themselves in alternative markets, with the UK being a major target, along with other countries in Southeast Asia, and the Middle East. For example, BYD sell more cars in the UK now than in any other country outside of China (BBC News), a trend that is only set to continue.

However, Chinese brands entering the UK market doesn’t automatically result in Brits deciding to buy or lease a Chinese car over more established manufacturers; they must bring cars which people want. Overall, it seems that they do. But how?

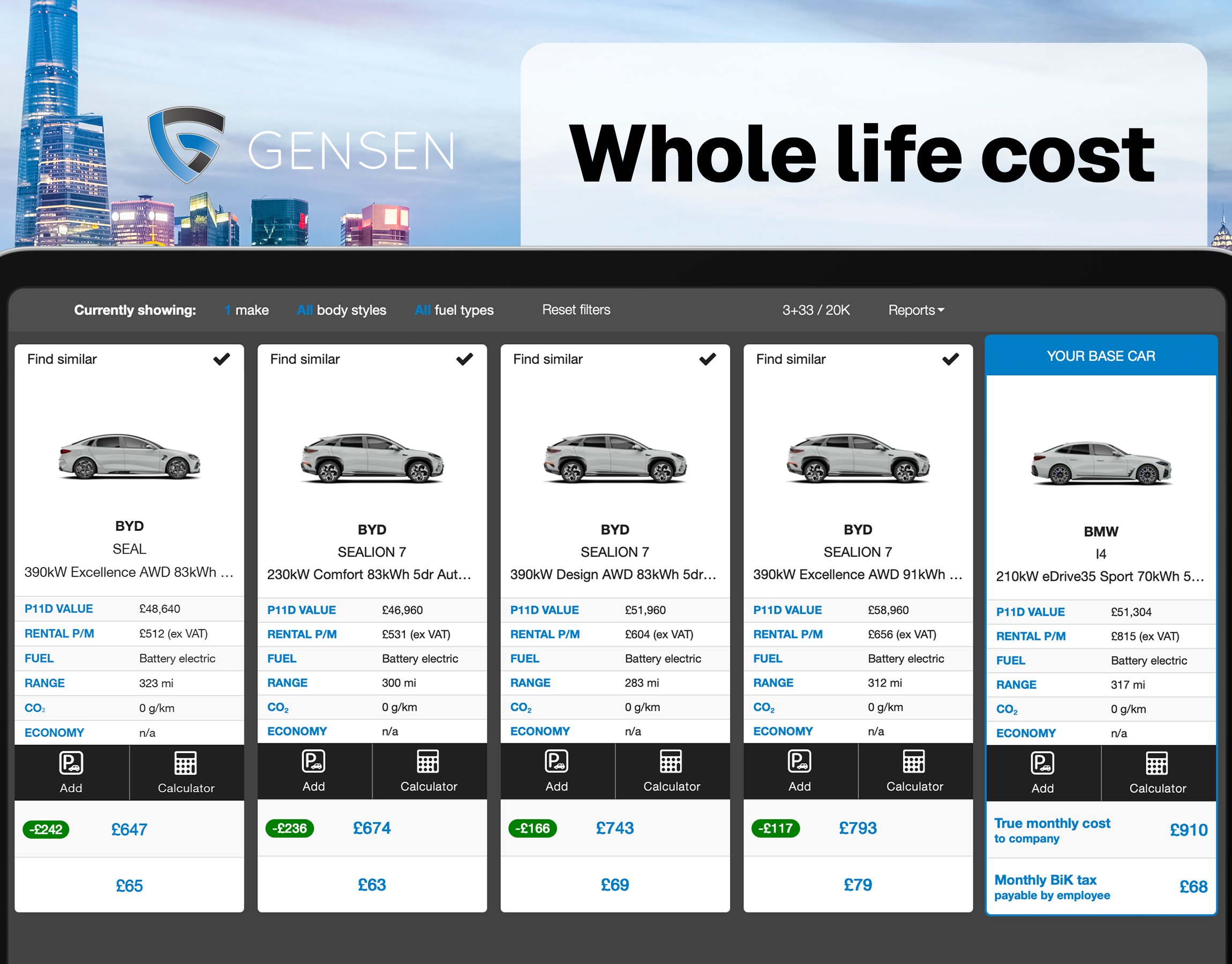

Take the Tesla Model Y and the BMW i4 for example, two of the most popular EVs in the UK, both within the same category, yet Gensen shows that their base models have considerably higher Whole Life Costs (“WLC”) than the top of the range BYD Seal, which is a direct competitor; the Seal has more power and a longer range than the i4 and Model Y too. Could it be as simple as UK motorists realising there could be better, more cost-effective options on the market than those offered by historically popular manufacturers?

BMW i4 vs BYD - Whole Life Cost comparator in Gensen Software

This change in the market could end up being quite positive for the average person considering which car they would like to drive, because it could force non-Chinese manufacturers to reassess their EV models, and either reduce prices or increase specifications in order to compete with the new Chinese brands.

Contact us if you would like to discuss any of the content on this page.