How do all the new Chinese brands compare to each other?

BYD, the Chinese car manufacturer which has recently overtaken Tesla as the world’s premier electric car (“EV”) retailer, has seen a massive boom in sales in the UK in the last couple of years, where it accounted for 2.54% of new car registrations in the UK in 2025, up from 0.45% for the whole of 2024 (SMMT, 2025).

With several other Chinese manufacturers having entered the UK market in the same timeframe, BYD is the first to rapidly capture market share from more established manufacturers, but others such as Jaecoo and Omoda are beginning to match BYD’s popularity, and could possibly outstrip it within the next year or two. This is evidenced by many large UK dealership groups such as Hendy are opening BYD franchises, with Jaecoo & Omoda franchises on the way very soon (Car magazine, 2026).

MG and Volvo currently hold a larger market share than BYD, 4.21% and 3.4% respectively. Although they are both owned by Chinese companies, they are both well-established European brands which are very well known in the UK. Therefore, for the purposes of this article neither will be considered as new Chinese entrants into the market.

Within Carwow’s list of the best 10 Chinese cars in the UK in 2025, 4 are BYD models; the Seal, Sealion 7, Atto 3 and Dolphin to be specific. No other new entrant has more than one model in the list.

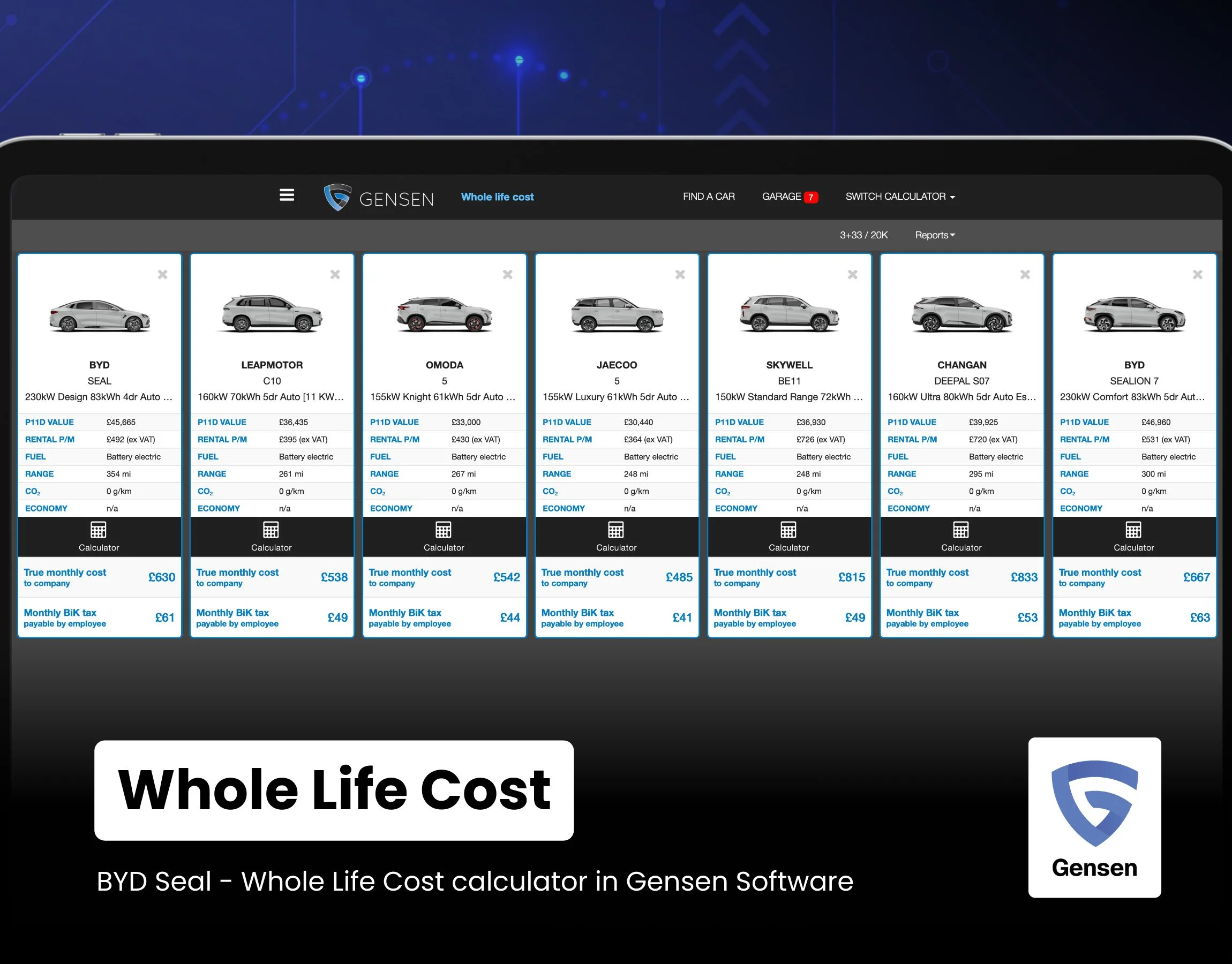

BYD Seal - Whole Life Cost calculator in Gensen Software

Even though BYD models tend to have higher list prices than other Chinese brands, their Whole Life Costs (“WLC”) are typically very competitive, as you can see in a screenshot from BCF Wessex’s Gensen WLC software below. For example, the base model BYD Seal, which takes top spot in Carwow’s list, has a list price around £46,000, which is at least £10,000 higher than the base models of the Jaecoo 5, Omoda 5 or Leapmotor C10; however, on average the WLCs of the BYD Seal is only around £100 per month higher, despite offering greatly superior range and boasting better reviews.

The BYD Seal is also cheaper than the base models of the Xpeng G6, Changan Deepal S07 and Skywell BE11.

However, a more comparable BYD model would be the Sealion 7, which is closer to an SUV. Using Gensen you can see that pricing for the BYD Sealion starts around £47,000, only £1,000 more than the Seal, but it is around £70pm higher on WLC. Whilst the Sealion still receives good reviews, looking at the numbers punters could, and probably should choose more cost effective models from Jaecoo, Omoda & Chery

BYD versus Chinese rivals - Whole Life Cost comparator in Gensen Software

Unfortunately, not all the new models entering the market are garnering positive reviews; the Skywell BE11 is highlighted by both Carwow and Whatcar as the worst Chinese model to enter the UK in 2025, despite it being one of the most expensive entries, 27% more expensive than the BYD Seal on WLC.

Although we’ve seen several new Chinese brands enter the market, other than BYD only a couple have seen anything close to real success so far.

Jaecoo sold around 28,000 cars in the UK in 2025, giving it a 1.4% share of the market. Omoda meanwhile sold around 20,000 cars in the UK last year, giving it a 0.98% share of the market. Chery owns both Jaecoo and Omoda, so in terms of market penetration when the three brands are grouped together they just outstrip BYD, but individually the brands are still lagging behind BYD.

However, with Jaecoo having captured a 1% market share within less than 1 year of launching in the UK, and faster than any other manufacturer has achieved that milestone, it may be just a question of time before it overhauls BYD in the UK.

No other Chinese brand has surpassed 0.21% of the market, with brands such as Skywell having only sold roughly 30 cars in total.

It’s unlikely every new Chinese entrant will experience the success of BYD, Jaecoo or Omoda but the current trend of positive reviews and cheap prices seem to indicate that we will see more of the Chinese brands on our roads over the coming years, as they begin to dominate the UK market.

Contact us if you would like to discuss any of the content on this page.