Bestselling EVs of 2025: a comparison

Last month saw the Society of Motor Manufacturers & Traders (SMMT) publish its top-selling cars of 2025 list, and the data makes for some very interesting reading.

Of particular note, last year saw a 3.5% increase in registrations compared to 2024, with new-car sales surpassing 2 million for the first time since the pandemic, but still lagging by approximately 25% from the market highs seen in 2016. Electric cars saw a huge increase in units ordered in 2025, with approximately a 24% year on year increase, but what has prompted the change?

An EV surge

The reasons for the increase are numerous, with the introduction of the new EV car grant, which offers up to a £3,750 discount on EVs listed at £37,000 and below, definitely boosting interest during the second half of the year. Although the grant itself is quite restrictive, with only a handful of models achieving the full discount, it prompted manufacturers such as BYD, Omoda, and Jaecoo, as well as Dacia, to offer matching discounts of their own.

The Zero Emission Vehicle (“ZEV”) mandate has undoubtedly played a part, with manufacturers legally required to sell more EVs than ever before; however, with the mandated target for EV sales being 28% of all new cars registered in 2025, only 21% was achieved. This means EV incentives will continue to be needed for several years, including low BiK tax and salary sacrifice, both of which power EV fleet sales.

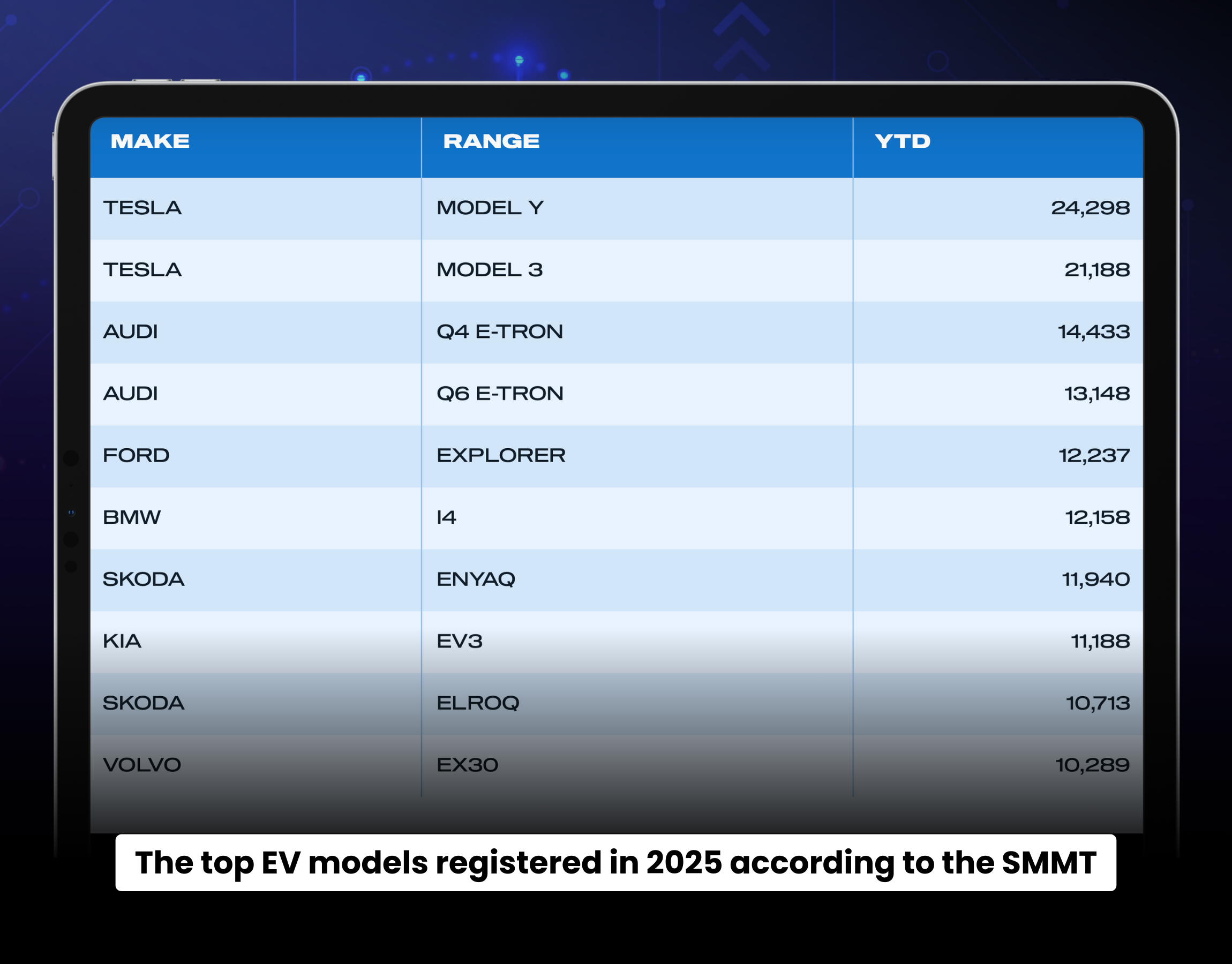

2025’s top EV models registered

Tesla’s Model Y and Model 3 commanded first and second spots, achieving sales figures 50% higher than the next most popular car.

SMMT - 2025 top BEV models registered in 2025

Although these results from Tesla are impressive, both models still fell short of the top 10 models sold in the UK; even the 10th-highest-selling model, the Hyundai Tucson, outsold the Tesla Model Y by approximately 18%. This demonstrates that, even with the ZEV Mandate demanding ever higher sales, EVs still have some way to go before they can be truly considered among the mainstream cars chosen by UK drivers.

Mirroring other European markets, Tesla experienced a 10% decline in UK sales in 2025 compared to the previous year (SMMT). This reflects the trend highlighted in our recent articles, notably that there is now a much greater choice on offer within the EV market, and we expect the top-selling cars of 2026 will be drastically different to those of 2025 as Chinese manufacturers consolidate their position.

An evolving market

With a clear evolution occurring in the UK’s EV market, it’s becoming increasingly evident that many new models experience a rapid boost in popularity; the MG4, for example, was UK car of the year in 2023, but last year its sales faltered, and it failed to register in 2025’s most popular EV list.

Tesla, Audi and Skoda all have two models in the top 10 most popular EVs of 2025, which highlights a couple of interesting points:

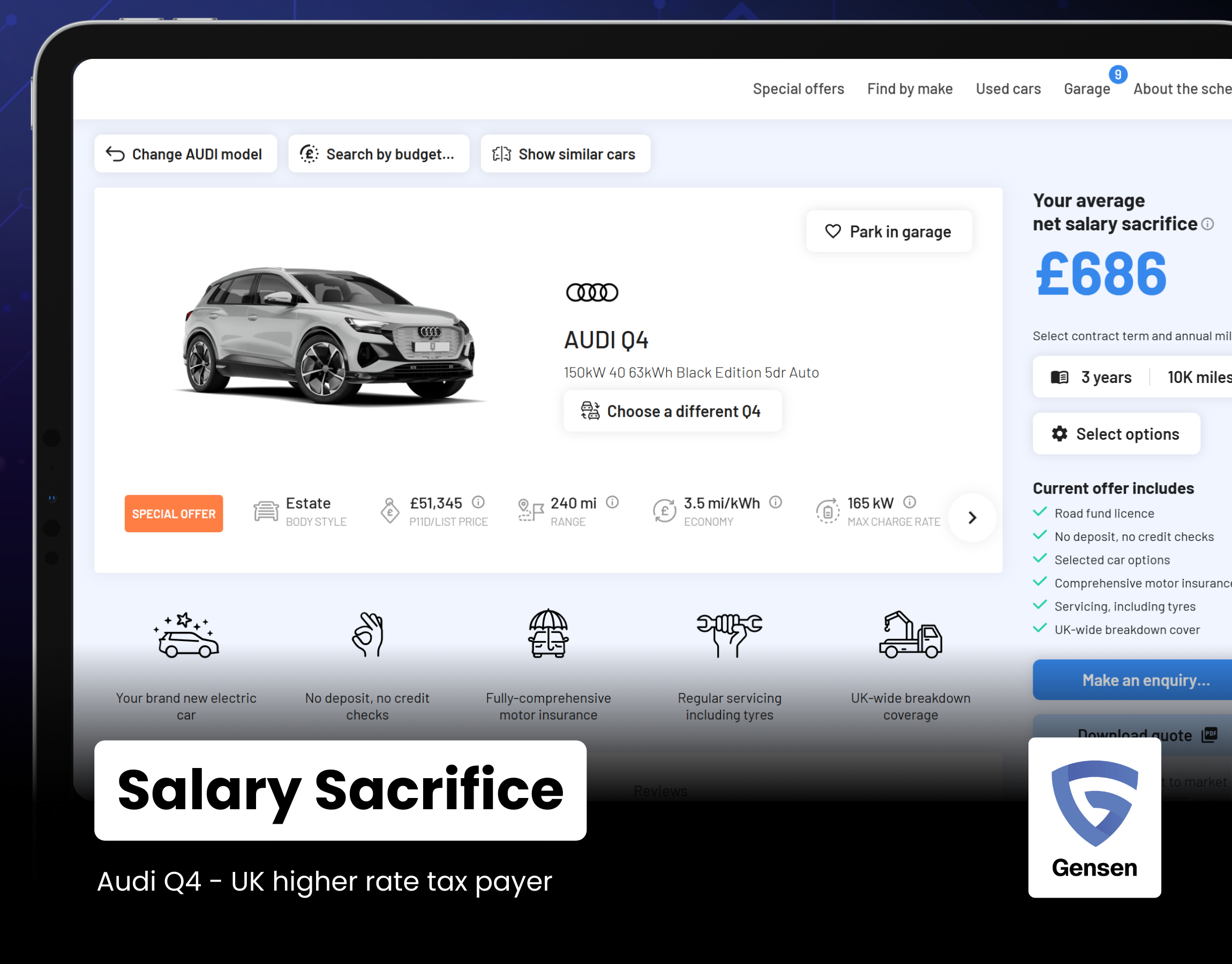

Audi emerged as the leading competitor to Tesla in terms of units sold, but it appears to be the choice for higher-end luxury EVs in the UK. Perhaps a result of salary sacrifice giving drivers the opportunity to drive luxury EVs at a greatly discounted cost, especially for those on higher and additional tax rates.

Skoda appears as the leading choice among more affordable EV manufacturers in the UK.

AUDI Q4 - Salary sacrifice overview in Gensen Software

But how could this change next year? Given the monumental rise of Chinese manufacturers here at BCF Wessex, we would be very surprised if models such as the BYD Seal, Jaecoo 5 or Omoda 5 aren’t seen in the EV best sellers list for 2026.

Our most sought-after EVs (and a nostalgia bounce?)

Tesla captured first and second spots in our Gensen Salary Sacrifice platform, as it did in the UK, but the similarities didn’t stop there. The six most popular EVs overall also performed well in Gensen last year; however, there were notable differences.

The Skoda Elroq and Volvo EX30 didn’t feature in the leading 25 cars in Gensen, despite being SMMT top 10 best sellers.

And although the Skoda Enyaq and KIA EV3 were featured in Gensen’s list, they still received fewer enquiries than other, more surprising cars such as the Renault 5 and the Porsche Macan, both of which were recent launches. This subtle difference could be nostalgia-driven, with the re-use of previous iconic model names resonating with drivers. VW appear to be taking notice here with the ID.2 being rebranded as the instantly recognisable and soon-to-launch ID. Polo (including an iconic GTi version). Future models are set to combine the "ID" prefix with traditional names like Golf and Tiguan to better connect with consumers.

Gensen Salary Sacrifice - Top 10 (2025 alongside 2024 figures)

Generally, popularity within Gensen reflects that within the UK as a whole; some established brands in the EV market, such as Tesla, Audi and BMW, have retained prominence throughout the huge EV diversification in the market. There is a great deal of change occurring in the overall market, as new models are released, the technology improves, with new manufacturers seeking to fill gaps in the market, as evidenced by the increasingly strong performance of the Chinese manufacturers.

Chinese models, the BYD Seal, Omoda 5 and Jaecoo 5 all saw marked increases in enquiries in Gensen Salary Sacrifice, not quite breaking into the top 10, but certainly knocking on the door.

The most sought-after model from a new Chinese entrant was the Omoda 5, which is notable given that Jaecoo and BYD were the two new entrants with the highest sales and market share in 2025.

In 2026, we expect all these models to be amongst the top 10. Value pricing, improved perceptions of quality, generous specifications, and pervasive marketing have ensured that brands from Chinese manufacturers are moving to the forefront of the EV market.

Whilst Chinese manufacturers haven’t seen the same level of penetration within Gensen Salary Sacrifice as the wider UK show, the analysis of the Gensen Top 20 would suggest that the popularity of the Chinese OEMs are likely to advance rapidly this year, reflecting the startling growth highlighted in our previous two-part analysis of the Chinese OEM’s rapid capture of a seventh of the UK market within a year.

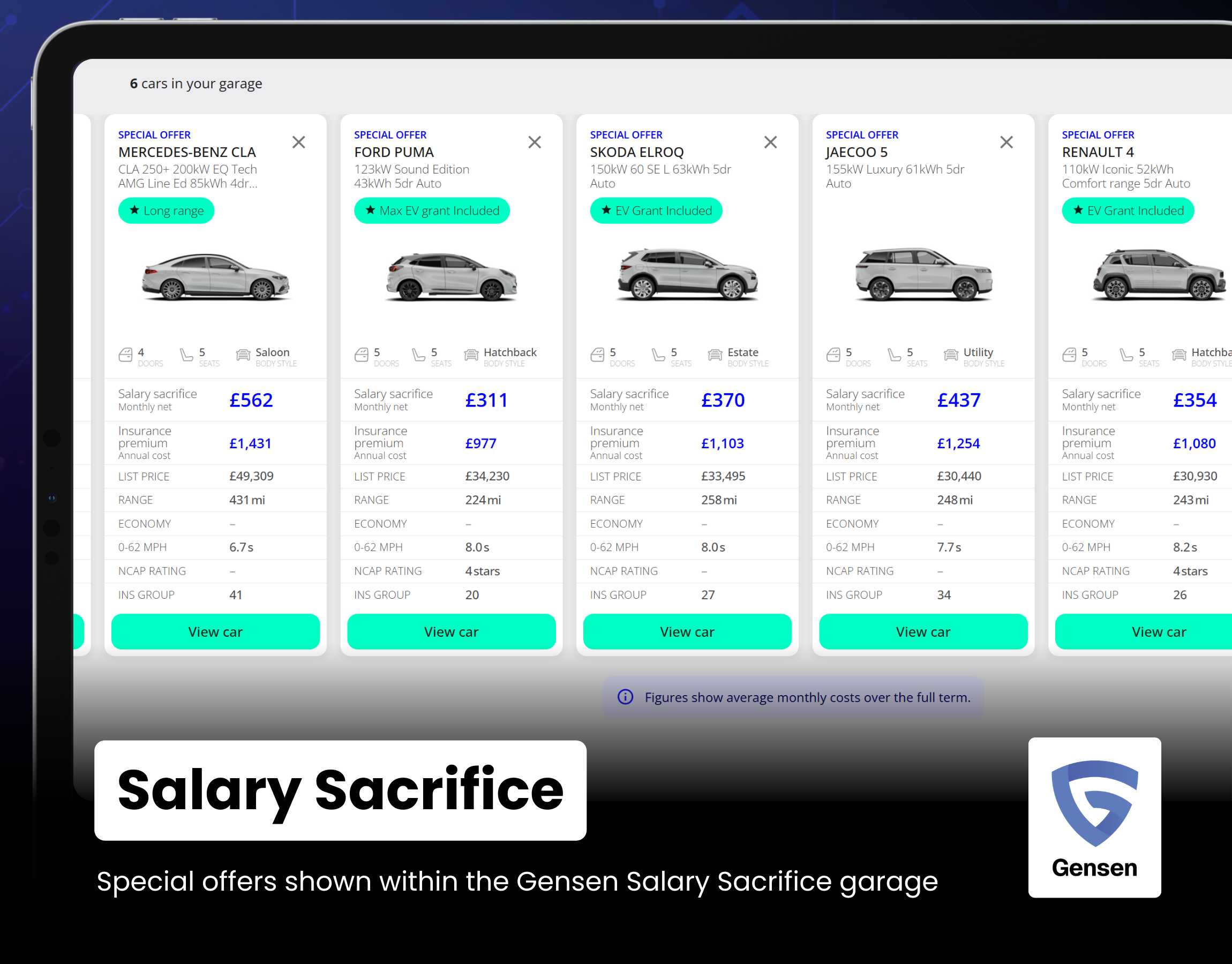

Special offers

Meanwhile, our clients report that a significant proportion of enquiries submitted via Gensen Salary Sacrifice are special offers, underscoring the importance of marketing in salary sacrifice. Like retail customers, drivers seeking a salary sacrifice car appear to be strongly drawn to deals. Therefore, given the current state of the EV market, with manufacturers competing aggressively, it’s imperative that providers regularly refresh the stock and special offer deals available via their salary sacrifice schemes (and regularly communicate special offers to the companies they work with).

A user’s selection of vehicles for quick comparison, within the Gensen Salary Sacrifice garage

Contact us if you would like to discuss any of the content on this page.